Saturday, March 11, 2023

Welcoming CSX Corporation (CSX) in my US portfolio!

Monday, February 27, 2023

The ugly true about the hidden cost of my margin account debt

Saturday, February 25, 2023

Paying Down Margin Debt: Why It's the Right Move Now

Thursday, February 23, 2023

MoneySense's Top 100 Dividend Stocks of 2023: Insights into the Best Income-Generating Opportunities

Many of the stocks featured in that Canadian dividend stocks list are already in my investment portfolio. Here are my winners, along with their respective dividend yields:

Labrador Iron Ore Royalty Corporation (LIF): 7.812%

Enbridge Inc. (ENB): 6.927%

TransCanada Corp (TRP): 6.777%

Pembina Pipeline Corporation (PPL): 5.849%

Bank of Nova Scotia (BNS): 5.757%

Whitecap Resources Inc. (WCP): 5.688%

Power Corporation of Canada Subordinate Voting Shares (POW): 5.556%

Canadian Imperial Bank Of Commerce (CM): 5.547%

Telus Corp (T): 5.12%

Emera Incorporated (EMA): 5.112%

Suncor Energy Inc. (SU): 4.69%

ATCO Ltd. (ACO.Y): 4.421%

Toronto-Dominion Bank (TD): 4.205%

North West Company Inc. (The) (NWC): 4.18%

Fortis Inc. (FTS): 4.088%

National Bank of Canada (NA): 3.918%

Royal Bank of Canada (RY): 3.867%

Quebecor Inc. (QBR.B): 3.695%

Northland Power Inc. (NPI): 3.622%

Stelco Holdings Inc. (STLC): 3.178%

Rogers Communications Inc. (RCI.B): 3.066%

Canadian Apartment Properties Real Estate Investment Trust (CAR.UN): 2.974%

Finning International Inc. (FTT): 2.677%

TMX Group Limited (X): 2.573%

Nutrien Ltd. (NTR): 2.444%

Canadian National Railway Co (CNR): 2.023%

Boralex Inc. Class A Shares (BLX): 1.796%

Thomson Reuters Corporation (TRI): 1.596%

Metro Inc. (MRU): 1.549%

Toromont Industries Ltd (TIH): 1.521%

Loblaw Companies (L): 1.392%

TFI International Inc. (TFII): 1.135%

Cargojet Inc (CJT): 0.917%

Alimentation Couche-Tard Inc. (ATD.A): 0.871%

WSP Global Inc. (WSP): 0.858%

Brookfield Asset Management Inc. Class A Limited Voting Shares (BN): 0.815%

Waste Connections Inc, WCN-T

Ccl Industries Inc Cl B NV, CCL-B-T

Imperial Oil, IMO-T

Ritchie Bros Auctioneers Inc, RBA-T

Brp Inc, DOO-T

Stantec Inc, STN-T

Element Fleet Management Corp, EFN-T

Monday, February 20, 2023

Investing beyond dividends: How some non-dividend paying stocks supercharge my portfolio

Sunday, February 19, 2023

Does Boyd Group Services Inc. (BYD) still belong to my TFSA portfolio?

Thursday, February 16, 2023

A stock that doesn't belong in my valuable investment portfolio: Manulife Financial Corporation (MFC)

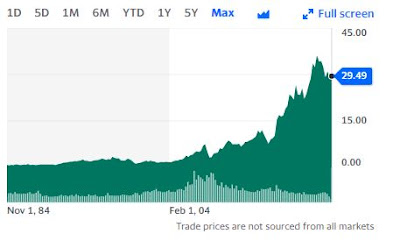

This is the overall chart of ACO.Y:

Tuesday, February 14, 2023

My newest investment idea: AG Growth International Inc. (AFN)

Monday, February 13, 2023

Historic of my Total assets and Net worth values on date of February 13, 2023

2023

Total in assets: $393,444.59/Net worth $346,786.01: January 6, 2023

2022

November 8, 2021

Total in assets: $364,072.52/Net worth: $315,407.64: July 26, 2021

Total in assets: $358,867.59/Net worth: $311,858.22: June 15, 2021

Total in assets: $354,774.64/Net worth: $307,559.30: June 10, 2021

Total in assets: $348,042.77/Net worth: $300,799.45 - FIRST TIME I EVER REACHED 300k in net worth, on May 26, 2021

Total in assets: $346,583.88/Net worth: $298,486.93: May 20, 2021

Total in assets: $349,651.45/Net worth: $298,435.31: May 7, 2021

Total in assets: $347,002.53/Net worth: $297,614.64: April 16, 2021

Total in assets: $338,188.16/Net worth: $287,914.75: March 11, 2021

Total in assets: $333,970.92/Net worth: $283,675.99: March 9, 2021

Total in assets: $328,881.12/Net worth: $279,611.57: February 10, 2021

Total in assets: $326,670.02/Net worth: $278,758.37: February 8, 2021

Total in assets: $324,891.52/Net worth: $276,979.87: February 4, 2021

Total in assets: $322,236.52/Net worth: $274,318.36: February 3, 2021

Total in assets: $327,639.01/Net worth: $274,298.23: January 19, 2021

Total in assets: $316,192.85/Net worth: $268,180.14: January 7, 2021

Total in assets: $313,003.95/Net worth: $264,915.22: January 6, 2021

Total in assets: $310,587.36/Net worth: $262,498.63: January 5, 2021

2020

Total in assets: $310,392.38/Net worth: $259,661.24: December 31, 2020

Total in assets: $307,812.05/Net worth: $259,070.79: December 24, 2020

Total in assets: $306,444.25/Net worth: $258,948.73: December 4, 2020

Total in assets: $304,701.39/Net worth: $257,331.58: November 27, 2020

Total in assets: $300,956.84/Net worth: $253,587.03: November 24, 2020

Total in assets: $298,903.01/Net worth: $251,533.20: November 23, 2020

Total in assets: $296,643.60/Net worth: $249,158.71: November 20, 2020

Total in assets: $294,514.87/Net worth: $247,145.87: November 11, 2020

Total in assets: $291,172.40/Net worth: $243,802.59: November 10, 2020

Total in assets: $287 803.13/Net worth: $240 433.32: November 9, 2020

Total in assets: $277,872.92/Net worth: $226,678.26: August 5, 2020

Total in assets: $276,627.27/Net worth: $227,745.47: June 6, 2020

Total in assets: $263,304.63/Net worth: $211,395.63: April 29, 2020

Total in assets: $241 461,13/Net worth: $194 558,29: March 13, 2020

Total in assets: $282,640.61/Net worth: $235,284.72: February 21, 2020

Total in assets: $304,955.72/Net worth: $257,187.44: February 12, 2020

Total in assets: $296,200.07/Net worth: $250,595: January 16, 2020

Total in assets: $292,715.58/Net worth: $244,970.41: January 9, 2020

2019

Total in assets: $288,237.52/Net worth: $239,582.44: December 31, 2019

Total in assets: $278,823.27/Net worth: $230,902.04: September 17, 2019

Total in assets: $271,896.19/Net worth: 226,137.05: June 24, 2019

Total in assets: $269 950.21/Net worth: $222 942.87: April 5, 2019

Total in assets: $251 634.94/Net worth: $206 278.84: January 18, 2019

Total in assets: $238 656.07/Net worth: $191 009.83: January 4, 2019

2018

Total in assets: $270 679.86/Net worth: $204 306.57: November 16, 2018

Total in assets: $332 750.88/Net worth: $232 609.15: August 3, 2018

Total in assets: $331 413.83/Net worth: $232 280.40: June 20, 2018

Total in assets: $326 085.75/Net worth: $226 801.92: June 3, 2018

Total in assets: $322 479.23/Net worth: $222 850.15: May 4, 2018

Total in assets: $319 644.86/Net worth: $217 246.23: March 16, 2018

2017

Total in assets: $318 544.64/Net worth: $221 989.65: December 29, 2017

Net worth on the date of November 17, 2017: $211 430.89

Net worth on the date of October 27, 2017: $212 633.39

Net worth on the date of September 29, 2017: $206 352.49

Net worth on the date of April 24, 2017: $204 277.66

Net worth on the date of March 31, 2017: $200 325.69

Net worth on the date of March 29, 2017: $198 299.73

Net worth on the date of March 18, 2017: $193 969.21

2016

Net worth on the date of December 30, 2016: $184 074.35

Net worth after debt on the date of January 1, 2014:

$101 172.99 (yes, finally, IN NET WORTH!).

On the date of February 16, 2011, the TMX hit 14 000+ points, and I exceeded the 150k in assets! (Not net worth yet).

On September 9, 2010, I reached $100,000 in assets! (not in net worth yet).

On the date of August 5, 2009, I reached my investment goal: I reached $50 000 worth of assets! (NOW, net worth).

On the date of December 5, 2009, I had exceeded $60 000 in assets! (not in net worth yet).

My investment portfolio on date of February 13, 2023

Cold cash: $16,359.37

Stocks and Units investment portfolio $CAN

RSP investment portfolio:

Others: $1,159.90

NBI Income Fund: $1,232.99

Sunday, February 12, 2023

Reflecting on my Investment Journey: A Detailed Review of My Debt and Portfolio Development from 2007 to Present

2010: The Year I Opened My Margin Account

Celebrating a Financial Milestone: Reaching My Personal Best Net Worth of $364,399.48

- I will add $15,000 to my savings by the end of the year;

- I will earn an equivalent of $1,013 per month in dividend income over the next 10 months, totaling $10,130;

- I will receive a 4% return on my current investment capital of $348,040.12 over the next 10 months, which would add up to $11,601.33.